Key Notes

- Robinhood’s integration enables decentralized equity trading on Arbitrum, eliminating traditional intermediaries.

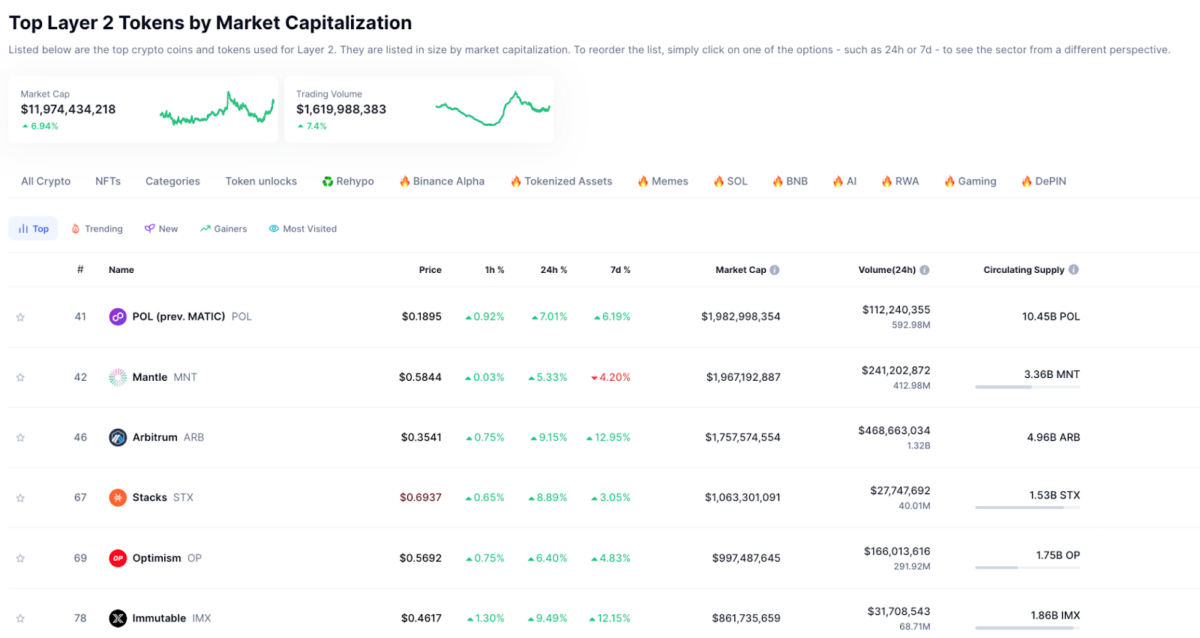

- Layer-2 tokens gained over 8% collectively, adding $1 billion to the sector’s $11.9 billion market cap.

- Technical analysis reveals a double bottom pattern suggesting potential 120% upside target near $0.76.

ARB price surged 9% to hit $0.35 on July 2 as Robinhood’s launches US stocks trading on the Arbitrum Layer-2 network, while Donald Trump’s ceasefire announcement further boosted market sentiment.

Arbitrum Pulls 9% Gains in 24 Hours as Robinhood Launches US Stocks

Arbitrum

ARB

$0.35

24h volatility:

7.4%

Market cap:

$1.74 B

Vol. 24h:

$489.97 M

rallied 9% on Wednesday, July 2, trading as high as $0.35 at press time, as it printed its first daily green candle of the week. The momentum behind ARB is driven by Robinhood’s announcement of US stock trading on the Arbitrum network and driving rapid capital flows towards Layer-2 markets.

Introducing The Robinhood Chain.

The first Ethereum Layer 2 optimized for real-world assets via @arbitrum—from public to private to global.

You shouldn’t have to rely on a broker to trade assets. Instead, you should be able to seamlessly trade real-world assets in seconds.… pic.twitter.com/nDqEyduOED

— Vlad Tenev (@vladtenev) July 2, 2025

Robinhood’s bold move expands Arbitrum’s use case well beyond DeFi and gaming. According to Robinhood Founder Vlad Tenev the move enables trading of real-world equities on a decentralized, low-fee Layer-2 network eliminating intermediaries and brokerages.

The news also boosted the broader Layer-2 sector, as Polygon

MATIC

$0.19

24h volatility:

7.3%

Market cap:

$278.05 M

Vol. 24h:

$1.59 M

, Mantle

MNT

$0.59

24h volatility:

4.4%

Market cap:

$1.97 B

Vol. 24h:

$207.25 M

, and ARB each posted intraday gains above 8%. According to Coinmarketcap data, the Layer-2 sector surged 7%, hitting a $11.9 billion market cap after adding over $1 billion in 24 hours.

US President Donald Trump further boosted the broader crypto market sentiment, confirming a landmark trade deal with Vietnam on Wednesday, after announcing a ceasefire between Israel and Palestine. With macro tensions cooling, Bitcoin rallied above $110,000 on the day, further boosting investor’s risk appetite for rallying mid-cap altcoins, including Abitrum.

Arbitrum Price Prediction: Is ARB on the Verge of a 120% Breakout?

Arbitrum price action on the daily chart presents a classic double bottom pattern, a bullish reversal signal that occurs when price tests a key support level twice and rebounds strongly. In this case, ARB found repeated support near $0.30 and is now trading at $0.35 after 9% intraday gains.

Arbitrum price forecast | TradingView

This double bottom pattern suggests buyer strength at the $0.30 level and positions ARB for a potential breakout. Calculated by projecting the distance between the bottoms and the neckline onto the breakout zone, the Double Bottom pattern now indicates a bullish target near $0.76, a possible 120% upside from the current level.

More so, the RSI gauges the speed and change of price movements, with values above 70 signaling overbought and below 30 indicating oversold. Arbitrum’s Relative Strength Index (RSI) is currently trending at 55.26, signaling growing bullish momentum is yet to reach peak overbought level.

Volume on the breakout day also surged to 143.85 million ARB, confirming active buyer interest despite approaching double-digit intraday uptick. Traders should watch for follow-through above the $0.50 level, which previously acted as resistance. If ARB clears that, it could validate the breakout path toward $0.76.

On the downside, failure to hold the $0.30 support in the short-term could trigger rapid correction toward the next significant support at $0.25

Snorter Gains Adoption As Meme Traders Rotate Profits From Layer-2 Tokens

While Layer-2 coins like Arbitrum ride fundamental waves, memecoin traders are now eyeing Snorter, a Solana-based meme bot trading protocol currently in presale.

With over $1.3 million raised, Snorter offers presale buyers access at $0.0965, including perks like staking, built-in DeFi utilities, and a trading bot optimized for memecoin scalping.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.