Nearly a quarter of young, new crypto investors are actively investing in meme-driven cryptocurrencies like Dogecoin, a survey by betting app Gamblers Pick found recently.

Meme narratives have spruced up the crypto space massively in the past few months driven by the likes of Dogecoin (and celebs like Elon Musk continuously shilling such coins). The ‘meme’ sector, as CryptoSlate data shows, commands over 3.43% of the entire crypto market cap and is worth over $70 billion at press time.

Choose memes, choose Dogecoin

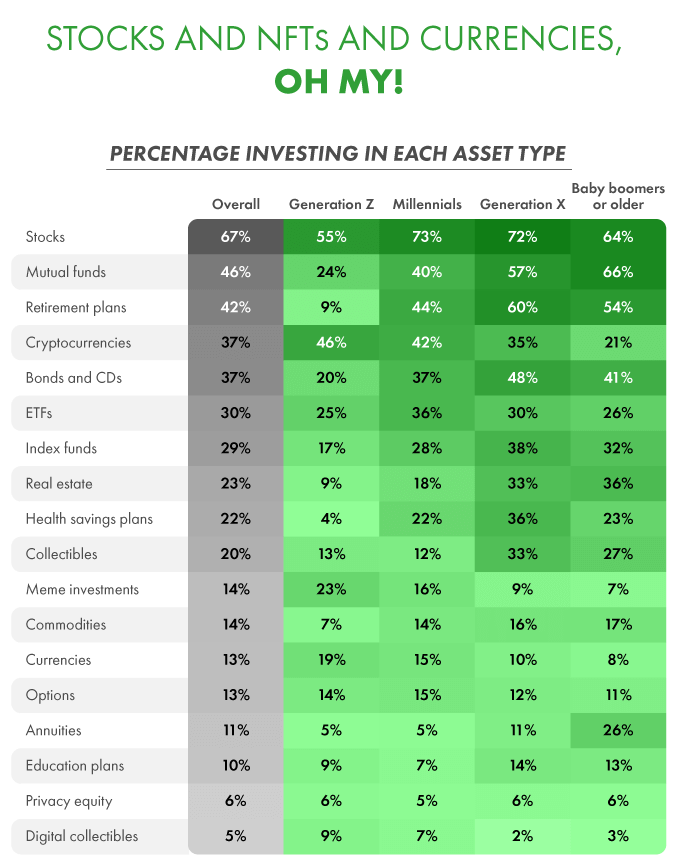

The study asked 872 people about their investment strategies to explore how different generations were investing across financial markets.

Twenty-four percent of those respondents were ‘Gen Zers’ (born between late 1990-early 2010s), 27% were millennials (born between 1980-1995), 25% were Gen Xers (mid-1960s to early 80s), and 24% were baby boomers or older (post the world wars and 1960s).

Overall, a quarter of respondents admitted to investing frequently and said that it was a relatively popular activity among them, as only 12% said they rarely did it. On a generational level, Gen Zers couldn’t get enough of the practice, with over 28% said they were constantly investing.

A staggering 55% of Gen Zers, as per the survey, said they were investing majorly in the stock market against the 46% who said they paid long-term crypto bets. 23%, interestingly, said they actively invested in ‘memes’ (think Dogecoin, Shiba Inu, and others).

16% of Gen Xers said they dabbled in memecoins as well, while a small (and probably adventurous) 7% of baby boomers stated they invested in memes.

NFTs losing charm

Only 9% of the surveyed participants said they made investments in digital ‘collectibles,’ or non-fungible tokens (NFTs), with other generations—7% for millennials, 2% for Gen Xers, and 3% for Baby Boomers—investing even less.

The low interest in NFTs is in line with the overall decline of the sector. Recent sales data shows NFT prices are falling across the board and there are fewer overall takers for the new-age tech—suggesting 2020’s NFT frenzy could, for the most part, have been a fad.

As such, as per the data, Gen Zers were less likely to invest in NFTs but more likely to invest in clothing and sneakers instead.

Social media-driven investing

The survey found Gen Z’s investment habits were more likely to be influenced by Reddit, Twitter, and other social media, while older generations are more likely to have their investments influenced by magazines, newspapers, and TV.

Gen Zers were also less likely to invest in a majority of typical/traditional/common assets but more likely to invest in cryptocurrencies, meme investments, currencies, and NFTs.

Meanwhile, the leading reason for Gen Z and millennials to invest was mainly to save for the future (48%) and to make a modest amount of money (49%). A small section, however, did it to “play the game” (28%) and to “fight back against institutional investors (22%), with some even stating it was their way of gambling (14%).

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Like what you see? Subscribe for updates.