Stocks of Chinese publicly listed companies fell sharply today after cryptocurrencies like Bitcoin, Ethereum, and others plunged massively on Wednesday, data from multiple sources shows.

Yesterday saw over $8 billion in liquidations (or collateral that is seized by exchanges after asset prices hit a predetermined price level) and over 350,000 trading accounts getting liquidated as Bitcoin, Ethereum, and other cryptocurrency fell by double-digit percentages.

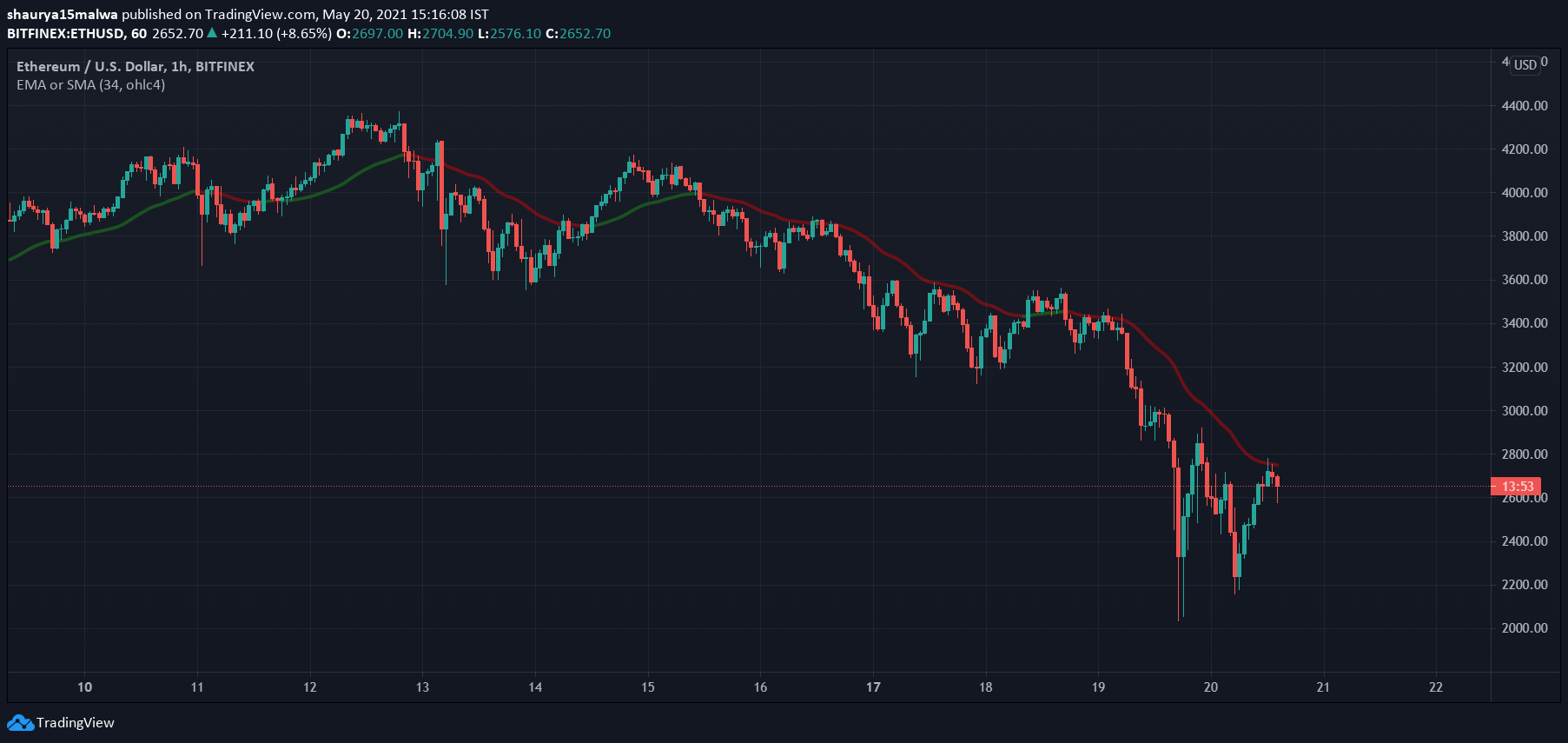

Bitcoin fell to as low as $29,000, Ethereum to $2,000, with some DeFi majors like SushiSwap (SUSHI) dropping as much as 40%. And amidst all this, the companies related to cryptocurrencies—via treasury holdings or being part of the mining supply chain—took on big losses as well.

Public companies drop after crypto scare

Meitu, a Hong Kong Stock Exchange-listed photo editing company, tanked by 8% this morning. The photo-editing app holds millions of dollars worth of Bitcoin and Ethereum as part of its treasury funds, and traders likely reacted to yesterday’s downfall.

Several others saw similar outcomes. As per local daily South China Morning Post, an index tracking 50 stocks linked to cryptocurrencies fell 1.6% on the Shanghai and Shenzhen exchanges.

A mainland-listed company called Shenzhen Asia Link, which provides third-party payment services used by crypto companies, led that list, falling 10% in the session before its trading was shut down by the exchange.

Elsewhere in the US, Bitcoin-linked companies like MicroStrategy, and Tesla took hits as well, with MSTR losing -6% in the New York trading session and TSLA a relatively smaller -2%.

The drop came a day after a ‘FUD’ development out of China, one that stated the country could, once again, ban the usage of cryptocurrencies. The rumour was overblown however, with the report being a reiteration of a previous statement.

Meanwhile, the crypto market seems to be moving upwards at press time, with buyers stepping in last night. ETH gained over 9% and trades at $2,665, while Bitcoin trades just under $40,000. The fear and greed index tells another story, however, suggesting the market is in a state of “extreme fear” at the moment.

Bitcoin Fear and Greed Index is 11 — Extreme Fear pic.twitter.com/Ux1RRm1sgA

— Bitcoin Fear and Greed Index (@BitcoinFear) May 20, 2021

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Like what you see? Subscribe for updates.