Ethereum broke the $3,000 mark yesterday as top coins jumped on news of favorable legislation around cryptocurrencies in the US, data from multiple sources showed.

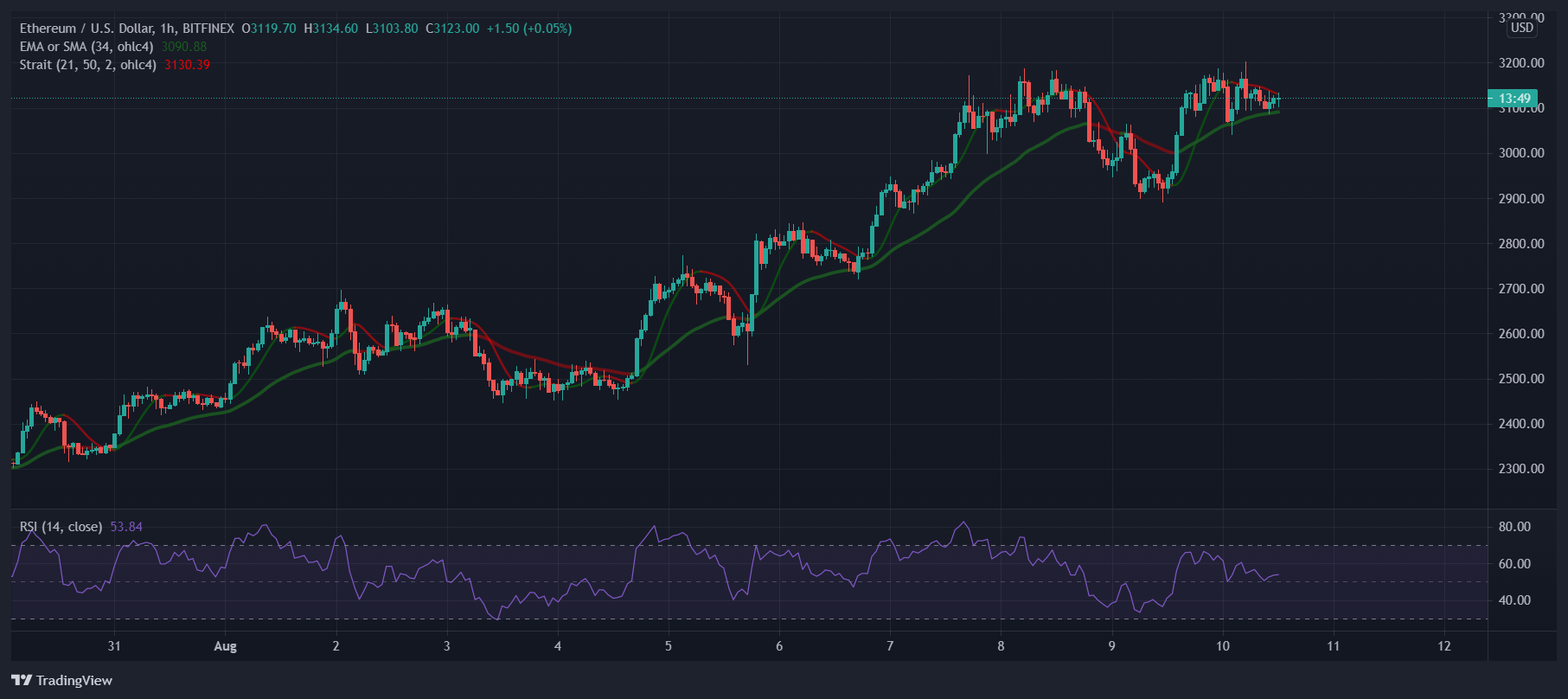

The asset trades slightly above $3,000 at press time, with a resistance zone at the $3,160 price level as the below chart shows.

It, however, remains in a firm uptrend, moving from $1,700 last month to today’s price level. The Relative Strength Index, a measurement used by traders to assess the price momentum of a stock or other security, is neither overbought nor underbought, signaling the asset is not headed for a correction.

Other cryptos leading the green charts were Dogecoin (+6%), Uniswap (+11%), and Litecoin (+9.4%), with Bitcoin and XRP pumping relatively lower with moves of just +4% and +2.9% respectively.

Why is Ethereum pumping?

A massive fundamental factor driving Ethereum is the recently deployed EIP-1559 update, one that burns a certain ETH each time a transaction is processed by miners on the network.

EIP-1559 was first floated in 2018 as a solution to fee volatility and stuck/delayed transactions and was one of the most crucial and anticipated developments to take place on the Ethereum blockchain since its inception in 2015.

The upgrade makes fees more predictable for Ethereum users. Unlike the earlier consensus design, a ‘base transaction fee’ is now charged to users after being algorithmically determined by how busy the network is, and users are, in turn, able to ‘tip’ miners to have their own transactions processed quicker.

And it’s a success. Over 20,980 ETH have been burned barely a week after launch, representing over $65 million at current prices. 3 ETH are burned each minute, with an average of 0.5 ETH being burned each block.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Like what you see? Subscribe for updates.