The cryptocurrency bull market seems to be back, with the market cap recently surpassing $2 trillion.

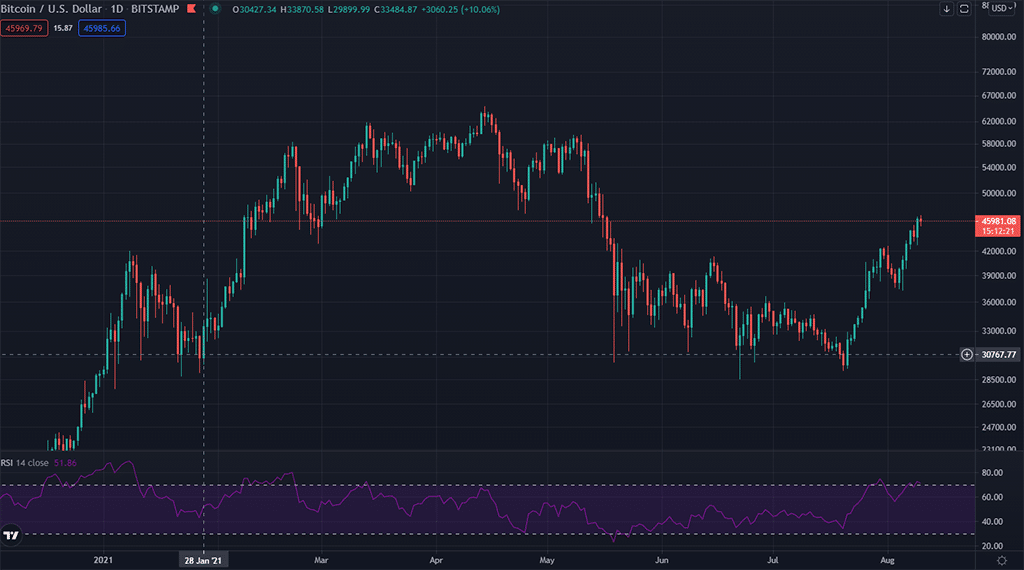

Bitcoin is currently trading at $47.5K while Ether hovers above $3,200, a significant surge from the lows of May 2021 when Bitcoin dropped to the $30K level and Ether was trading below $2,000.

Following the latest price action, crypto stakeholders are optimistic that the market will gradually hit all-time highs (ATH) again. Both fundamental and technical indicators are showing that cryptocurrencies might be heading for another leg up. Recent weeks have been particularly eventful, with the market flooding with bullish news.

Are We Entering Another Bull Market?

As much as crypto prices may be hard to predict, signs on the wall indicate that upcoming months are likely to be bullish. This can be seen in the fundamental developments that have taken place within the last two months.

For starters, Google announced that it has revised its cryptocurrency advert policy again. The tech behemoth had banned cryptocurrency adverts in March at the peak of the previous bull market, citing an increase in the number of scammers leveraging crypto to rip off unsuspecting investors.

In the latest development, Google has started to allow crypto adverts as of August 3. However, the revised policy features some limitations, given that only licensed crypto wallets and exchanges will be allowed to advertise on the platform. The crypto firms also have to be registered with a state or federal chartered bank.

Nonetheless, this move by Google has sparked bullish sentiments across the market. Some crypto analysts predict the change in approach could trigger wider adoption of cryptocurrencies.

Tether Mints 1 Billion USDT Tokens

Besides Google, there has been much action in the crypto market, with Tether minting over 1 billion USDT tokens in the first week of August. These USDT tokens were issued on the Tron network, which now facilitates about 53.5% of the 62.8 billion USDT tokens currently in circulation.

The last time Tether minted such a huge amount was in early January when the firm printed a record of 2 billion USDT tokens in a week. Looking back, this minting was followed by a 3-month bull market that saw Bitcoin peak at $68.4K. Could we be heading back there, given the current momentum?

While it may still be early to predict, Bitcoin seems to be out of the woods, at least for now. The leading crypto asset is showing solid signs of recovery, with some veteran traders buying $100k options for December 2021.

Bitcoin’s daily price action – Bullish trend reversal

Action Is Coming Back to DeFi

The bullish wave has boosted not only Bitcoin’s and Ether’s price but also DeFi native tokens. As it stands, the total value locked (TVL) in DeFi protocols has again crossed $80 billion, while some coins associated with this niche have gained over 50% within the past month.

Notably, there is also a gradual shift from centralized exchanges following the ongoing pressure by authorities to have them collect KYC documents.

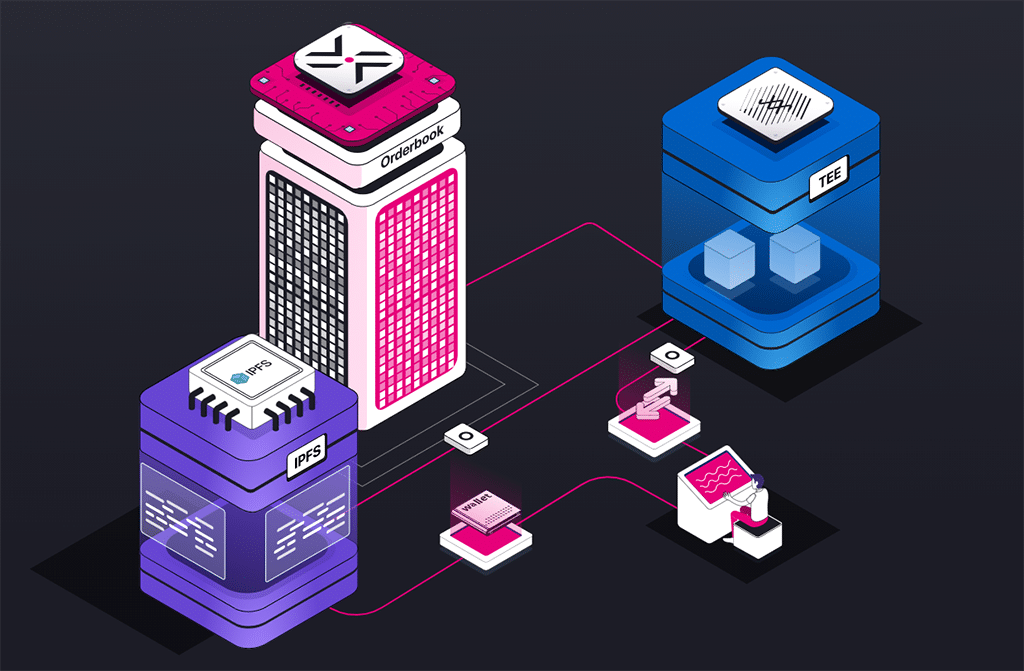

Crypto users are now opting for Decentralized Exchanges (DEXs) such as Polkadex, which provides a fully decentralized peer-to-peer crypto exchange. Built on substrate, Polkadex is the pioneer DEX to feature an order book-based crypto trading platform. Most of the existing DEXs use Automated Market Maker (AMM) models, which are not user-friendly as order books.

With Polkadex’s decentralized order book, DeFi investors and traders are exposed to high liquidity and advanced trading features, including high-frequency trading and trading bots. Notably, this DEX also leverages the aspects of centralized exchanges to feature a decentralized KYC option.

Essentially, the Polkadex trading environment is among the current action drivers in DeFi. This ecosystem also allows DeFi projects to launch through its IDO pallet and apply for listing on the Polkadex order book.

A Glimpse Into the Future

As the bullish sentiments continue to build up, one can only wonder where the market will gravitate towards in the next few months. Bulls are currently in control, with price action struggling to break past the $48K resistance level. Should it trend upwards, things might become interesting real quick.

Going by the crypto market history, the last two quarters of the year are usually the most bullish. This means that the bullish trajectory will likely continue, leading to a bigger run-up as we head towards the end of 2021.

While it may take longer than predicted, fundamentals such as Google’s acceptance of crypto adverts show that more stakeholders will be exposed to the potential of cryptocurrencies. It is also noteworthy that some jurisdictions, such as El Salvador, recently accepted Bitcoin as legal tender.

These developments and many others are fundamentally bullish and could be significant price drivers as we move to the next era of crypto adoption.

Conclusion

Crypto is gradually shaping up to rival traditional financial markets and other legacy ecosystems. The underlying potential in this area of innovation can now be seen in upcoming products, including DeFi and NFTs.

With all the action, the coming years will likely be marked by mainstream adoption and new all-time highs for Bitcoin. However, history has taught us that volatility could swing both ways. Only time can tell how high or low the market will swing.

Kseniia is the Chief Content Officer of Coinspeaker, holding this position since 2018. Now she is very passionate about cryptocurrencies and everything connected with it, so she tries to ensure that all the content presented on Coinspeaker reaches the reader in an understandable and attractive way. Kseniia is always open to suggestions and comments, so feel free to contact her for any questions regarding her duties.